In late August of 2015, Billy received an urgent call while vacationing with his family. The new CEO of the consumer bank was concerned about the pace of innovation and sales growth with younger, affluent customers. The brief was short and sweet: create the bank of the future – and do it in three weeks.

In a matter of days, Billy recruited the best and brightest strategists, designers, and producers from within Citi and outside, and orchestrated a two-week design sprint at Citi’s executive conference facility in rural, Armonk, NY. The team was intentionally kept small but with diverse expertise. Jeff Bezos would be proud.

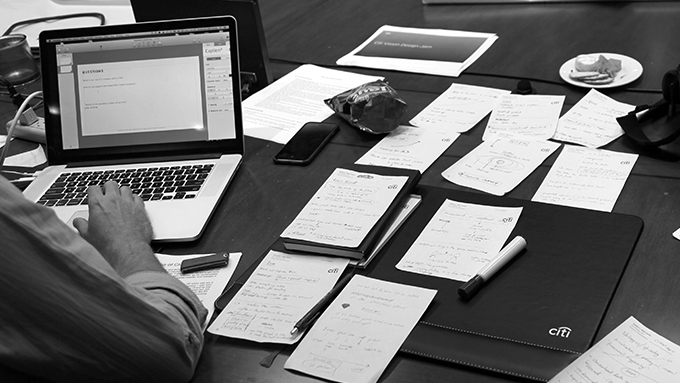

The two week sprint followed a disciplined, design thinking methodology to ensure the vision was grounded in customer insights and moved at the necessary pace. The team looked at analytics data, interviewed industry thought leaders and were inspired by cultural trend presentations from Critical Mass, Mastercard Labs, Prophet, and Sparks & Honey.

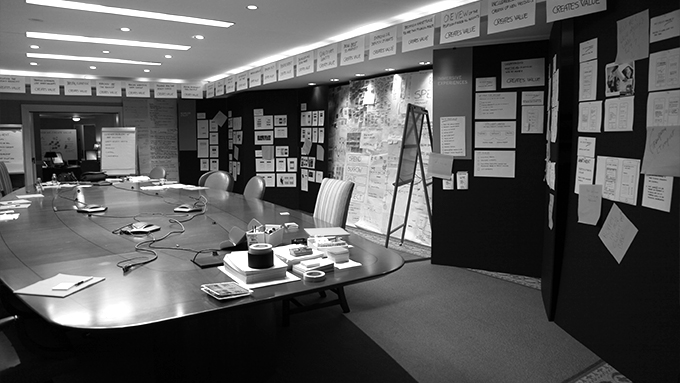

They conducted a series of group activities including empathy mapping and customer journey development to uncover big ideas and then brought the vision to life with illustrated diagrams, custom animations and paper prototypes.

After an intense couple of weeks, the team delivered a highly interactive presentation to the most senior leaders of the bank.

The presentation was a huge success – but it wasn’t just because of the content or presentation theater. More importantly, the small team proved that Citi could work at the same pace as Silicon Valley start-ups and apply the same techniques of strategic problem solving to create disruptive ideas. This is what excited the CEO – and this is what sparked the next big brief:

“Create a start-up organization within Citi that rapidly innovates what we deliver to customers and how we do it.”

Citi Fintech was founded a few weeks later and Billy was recruited to personally lead the design of the next generation, mobile banking experience while still managing his global design responsibilities.

Everything about Citi Fintech required new thinking. Billy oversaw the redesign of the office space and technology solutions to enable collaboration, research, design and prototyping. He recruited and co-located talented strategists, designers, technologists and producers including teams from Razorfish and Fluid in record time. And he implemented a two-week design sprint process including customer research, ideation, prototyping, user testing, and asset delivery for agile development.

Launching Citi Fintech was a massive challenge for everyone involved but it proved that radical change is possible in a 200 year old institution – and the customer will be better off for it.